income tax online malaysia

PROGRESSION -- The rates of individual income tax are usually progressive ie. Tax rates on consumption.

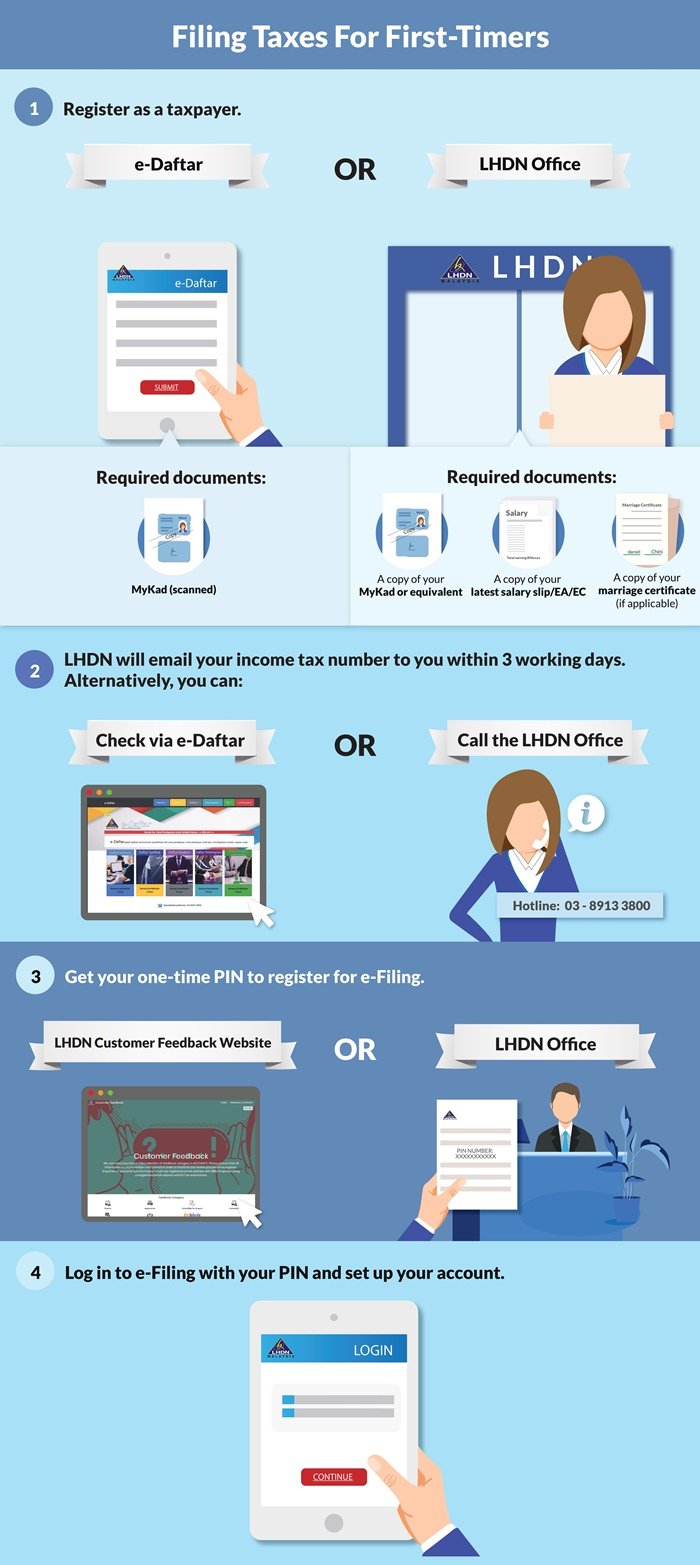

Guide To Using Lhdn E Filing To File Your Income Tax

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

. Apply online for car insurance now. This shorter version contains the full text of the Model Tax Convention but without the historical notes the detailed list of tax treaties between OECD member countries and the background reports that are included in the full-length loose-leaf and electronic versions. 30042022 15052022 for e-filing 5.

The capital gains tax in Finland is 30 on realized capital income and 34 if the realized capital income is over 30000 euros. Headquarters of Inland Revenue Board Of Malaysia. Free Online Salary and Tax Calculators designed specifically to provide Income Tax and Salary deductions for Individuals families and businesses.

Any payable balance resulting from the annual income tax return must be paid not later than the due date established for filing the return. Form 4506 has multiple uses and special attention must be taken when completing the form for a gift tax inquiry. Corporate tax rates and statistics effective tax rates.

Online Income Tax Payment. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. An increasing proportion of income must be paid in tax as the income increases.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Tax Offences And Penalties In Malaysia. Non-residents are subject to withholding taxes on certain types of income.

How Does Monthly Tax Deduction Work In Malaysia. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Our suites of tax calculators are built around specific country tax laws and updated annually to provide a dependable tax calculator for your comparison of salaries when looking at new jobs reviewing annual pay.

The system is thus based on the taxpayers ability to pay. However it is important to keep in mind that the taxpayer should have a net-banking account with an authorized bank to avail of the online tax payment facility. Tax Offences And Penalties In Malaysia.

How To Pay Your Income Tax In Malaysia. Self-Employed defined as a return with a Schedule CC-EZ tax form. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

Americas 1 tax preparation provider. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Form 4506 Request for Copy of Tax Return PDF is used to request a copy of previously filed tax returns with all attachments.

The form and instructions are available on IRSgov. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Nowadays taxpayers can use the facility of e-payment in order to pay direct taxes online.

The income tax rate for resident legal persons is 20 payment of 80 units of dividends triggers 20 units of tax due. The participating banks are as follows. Other income is taxed at a rate of 30.

Guide To Using LHDN e-Filing To File Your Income Tax. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. First of all you need an Internet banking account with the FPX participating bank.

This publication is the condensed version of the OECD Model Tax Convention on Income and Capital. How Does Monthly Tax Deduction Work In Malaysia. 30062022 15072022 for e-filing 6.

Get a quick quote and instant renewal for your car Insurance online to receive the best comprehensive coverage you need. Just upload your form 16 claim your deductions and get your acknowledgment number online. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Get information on latest national and international events more. Armenia Last reviewed 07 June 2022 20 April. PROFITS TAX -- Tax imposed on business profits in addition to ordinary income tax or as distinct from income tax imposed on other forms of income.

If a Malaysian or foreign national knowledge worker resides in the Iskandar Development Region and is employed in certain qualifying activities by a designated company and if their employment commences on or after 24 October 2009 but not later than 31 December. 1 Pay income tax via FPX Services. Hospital income insurance medical insurance and home content insurance protection to individuals and families.

Given below are the income tax rates for FY 2021-22 AY 2022-23 and FY 2022-23 under the old tax regime. Comparative information on a range of tax rates and statistics in the OECD member countries and corporate tax statistics and effective tax rates for inclusive framework countries covering personal income tax rates and social security contributions applying to labour income. Form P Income tax return for partnership Deadline.

In addition for the validation purpose the taxpayers also need. Introduction Individual Income Tax. Complete the form using the printed instructions.

The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. Here are the many ways you can pay for your personal income tax in Malaysia. Besides the insurance industry is.

Income tax return for individual who only received employment income Deadline. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check.

The capital gains tax in 2011 was 28 on realized capital income. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

How To Pay Your Income Tax In Malaysia. Guide To Using LHDN e-Filing To File Your Income Tax. Read latest breaking news updates and headlines.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. An individual is considered a Senior Citizen if an individual crosses the age of 60 years during the financial year. If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it was earned.

1 online tax filing solution for self-employed. Under the old income tax regime a higher tax exemption limit is available to senior citizens and super senior citizens. All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income.

If the employee is considered a non-resident for Mexican tax purposes the tax rate applicable to compensation will vary from 15 to 30. As a cash basis taxpayer you generally deduct your rental expenses in the. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia.

The first MXN 125900 of employment income received in a 12-month floating period will be tax exempt. Form B Income tax return for individual with business income income other than employment income Deadline. 20th day of last month of each quarter.

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

How To Check Your Income Tax Number

Public Bank Berhad Lhdn Income Tax And Pcb Payment

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Why It Matters In Paying Taxes Doing Business World Bank Group

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Complete Malaysia Personal Income Tax Guide 2018 Ya2017 Comparehero

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Cukai Pendapatan How To File Income Tax In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Guide To Using Lhdn E Filing To File Your Income Tax

Ctos Lhdn E Filing Guide For Clueless Employees

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

Withholding Tax On Foreign Service Providers In Malaysia

Solved This Is Individual Assignment About Inflations In Chegg Com

Comments

Post a Comment